In today’s fast-paced world, restaurants and cafes are constantly looking for ways to streamline their operations, enhance customer service, and ensure compliance with local regulations. One of the most crucial aspects of running a successful restaurant is managing transactions efficiently and meeting tax obligations. With the FBR POS Integration with Dineplan, businesses in Pakistan can now achieve both — seamlessly integrating point-of-sale (POS) operations with the Federal Board of Revenue (FBR) system.

What is FBR POS Integration?

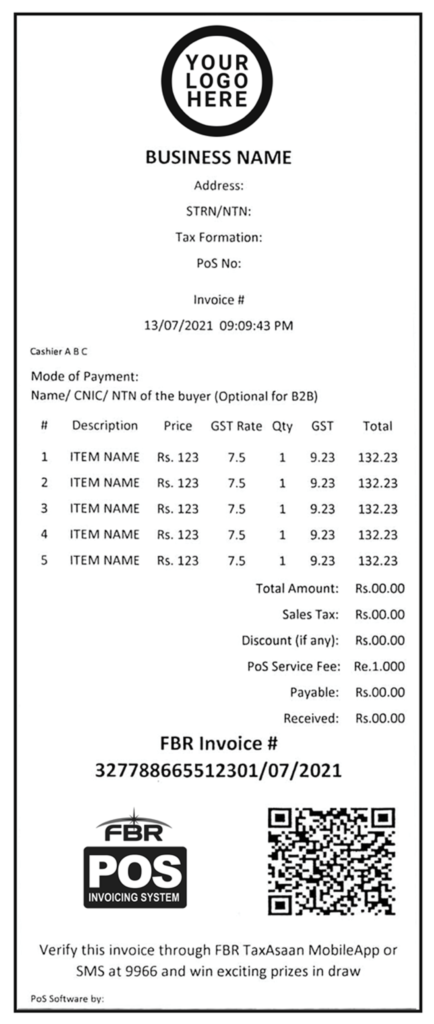

The FBR POS Integration refers to the link between a restaurant’s POS system and Pakistan’s Federal Board of Revenue (FBR). This integration is designed to ensure that all sales transactions are automatically sent to FBR for real-time tax reporting, helping businesses stay compliant with the government’s tax requirements. In other words, the POS system not only processes payments but also securely reports them to the FBR, ensuring transparency and reducing the risk of tax evasion.

Why is FBR Integration Important for Restaurants?

In Pakistan, businesses, including restaurants, are legally required to report their sales to FBR to ensure tax compliance. The integration of POS systems with the FBR helps businesses avoid penalties for non-compliance, ensures accurate tax reporting, and provides transparency in financial transactions.

For restaurant owners and managers, maintaining accurate financial records and ensuring tax compliance can be a daunting task. Manual bookkeeping can be time-consuming and error-prone, which could lead to serious consequences if errors go unnoticed. By integrating the POS system with FBR, restaurants can streamline their processes, automatically sending transaction data to the authorities in real time, making it easier for them to manage their finances and taxes.

How Does FBR POS Integration Work with Dineplan?

Dineplan, a leading restaurant management software, offers seamless POS integration with FBR. Here’s how it works:

- Automated Data Sync: Every time a transaction occurs on the POS system, the details (including item name, price, total amount, etc.) are automatically sent to Dineplan. Dineplan then formats this data according to FBR’s requirements.

- Real-Time Tax Reporting: Once the transaction details are processed through Dineplan, the information is sent to FBR in real time. This helps in tracking sales and taxes, making sure that businesses are always up-to-date with their tax obligations

- Elimination of Manual Errors: By automating the process, Dineplan reduces the risk of human error in tax reporting. Manual entries are often prone to mistakes, but with the FBR integration, this is eliminated, ensuring accurate and timely submissions.

- Compliance with FBR Regulations: The integration ensures that your business stays compliant with FBR’s requirements for sales reporting. By automatically sending the data to FBR, restaurant owners don’t have to worry about falling behind on tax obligations.

- Instant Updates and Reports: Dineplan provides restaurant owners with real-time reports of their sales and taxes, ensuring complete transparency. With just a few clicks, businesses can access comprehensive financial reports, helping them make informed decisions.

Benefits of FBR POS Integration with Dineplan

- Simplifies Tax Reporting: The primary benefit of this integration is that it simplifies the tax reporting process for restaurant owners. With automatic data syncing between the POS system and FBR, businesses can ensure that they are meeting all tax obligations without any hassle.

- Increased Accuracy: The FBR POS integration removes the chances of human errors in tax calculations and reporting. This leads to accurate tax filings, minimizing the risk of penalties or audits.

- Time-Saving: Automating the tax reporting process allows restaurant owners and managers to save time that would otherwise be spent on manual bookkeeping. The time saved can be redirected toward improving customer service or optimizing other areas of the business.

- Improved Customer Experience: With faster transactions and efficient backend processes, the overall customer experience improves. Customers benefit from quicker billing and seamless payment processing, which in turn boosts customer satisfaction.

- Transparency and Trust: FBR POS integration ensures that all transactions are reported accurately to the authorities, promoting a transparent business environment. This builds trust with both customers and government regulators.

Conclusion: The Future of Restaurant Management

The FBR POS integration with Dineplan is a game-changer for restaurants in Pakistan. It simplifies tax reporting, improves accuracy, and ensures compliance with local tax laws. By leveraging this integration, restaurant owners can focus on what matters most — delivering exceptional food and service — while leaving the complex task of tax reporting to the technology.

As the restaurant industry continues to evolve, adopting modern, integrated solutions like the FBR POS integration with Dineplan will become a necessity. By automating tedious tasks, restaurants can ensure smoother operations and compliance, helping them thrive in a competitive market. With the Dineplan POS system and FBR integration, your restaurant can focus on growing its business while leaving the regulatory complexities behind.

- Best Coffee Shops in Pakistan Using DinePlan POS for Seamless and Efficient Service

- Free FBR POS Integration Services With RetailPlan POS — Simplify Your Retail Business

- How Resellers Can Grow Their Business with ERP Solutions

- Maximizing Restaurant Efficiency with DinePlan POS System in Pakistan: A Complete Guide

- Unlocking Benefits and Efficiency of Using a POS System in Your Retail Shop